Your company could be quietly damaging your personal finances, and you might not even be aware of it. A shocking three-quarters of small business owners lack knowledge of how their business credit decisions impact their personal finances, potentially leading to massive losses in higher interest rates and rejected credit applications.So, will a busi

Not known Details About small business loan personal credit

Employing personal funds for business makes monitoring costs challenging. This may cause troubles if you can get audited.Personal loans will often be far more obtainable for new businesses due to the fact they count on personal credit and cash flow in lieu of business financials.Q. I've a garnishment on my paycheck that just happened. It will be co

The Fact About business loan affect personal credit score That No One Is Suggesting

Paying by the due date helps your credit, but skipped payments hurt it. Using personal financial debt for business could also ensure it is more durable to get other loans afterwards.Business loans can strain your money move with frequent payments — at times each day or weekly. Personal loans stick with every month payments, which can be a lot eas

How to Secure a Commercial Loan: Steer Clear of the 70% Rejection Rate

In excess of 70% of small business loan applications face rejection, often since applicants fail to grasp what banks prioritize. The gap between approval and denial usually comes down to preparation, not just the viability of your business. We’ll explore how to obtain a commercial loan and evade becoming the staggering rejection statistic.Why Do

business loan affect personal credit score Things To Know Before You Buy

Erica has been creating about small business finance and technology because 2008. She joined Merchant Maverick in 2018 and specializes in investigating and examining business application, monetary solutions, and various subject areas to help you small businesses handle and expand their operations.Defend your personal credit. Sustaining a difference

Mara Wilson Then & Now!

Mara Wilson Then & Now! Daniel Stern Then & Now!

Daniel Stern Then & Now! Kirk Cameron Then & Now!

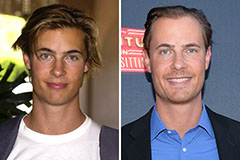

Kirk Cameron Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!